|

D.D. Premium |

|

Breaking News Market Moving News Affecting Our Portfolios Click here to update this page Reports are condensed. See stock's portfolio page for more details. analyst rating changes reported below do not reflect Div Det buy/sell ratings.

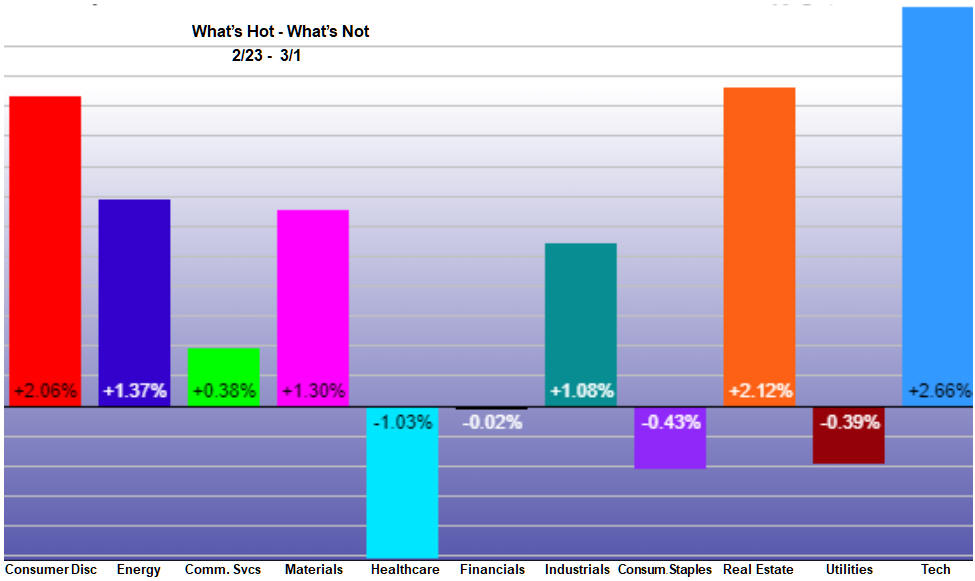

Last Weeks Best & Worst (2/23-3/1)

12/5: The March 2024 issue of D.D. Highlights is ready for download. Click here. 3/5: Analyst Buy/Sell Rating Changes Chemours (CC), cuts to neutral, target ↓$21, +5% upside For your information only, not Div. Det. recommendation change 3/5: Qualcomm (QCOM) increased its quarterly dividend by $0.05 to $0.85 per share. 3/4: DD Model Portfolios have been updated for March. Click here 3/1: Chemours (CC) said that it was putting its CEO and CFO on leave and delaying its audited financial filings as it conducts an internal investigation into its bookkeeping, compensation and ethics hotline reports. Chemours said the review, led by its audit committee, into "one or more potential material weaknesses" in controls over financial reporting also is taking into account "the 'tone at the top' set by certain members of senior management." What many perceived as likely a relatively minor accounting hangup two weeks ago now appears wider, longer, and with more ramifications than the market initially believed," according to an analyst. 3/1: Dominion Energy (D) is down this morning after saying in an investor presentation that it expects FY 2024 adjusted earnings in the range of $2.62-$2.87/share, below $3.03 analyst consensus estimate 2/29: Chemours (CC) replaced its CEO and Chief Financial Officer and indefinitely delayed release of its December quarter and full year 2023 numbers. 2/29: Analyst Buy/Sell Rating Changes Chemours (CC), cuts to underperform, target ↓$19, +12% upside For your information only, not Div. Det. recommendation change 2/28: Analyst Buy/Sell Rating Changes American Electric Power (AEP), cuts to equal weight, target ↓$83, 0% upside For your information only, not Div. Det. recommendation change 2/27: ONEOK (OKE) reported December quarter earnings of $1.18 per share, $0.04 above analyst forecasts, and up 9% vs. year-ago. Operating income up 46% to $1.099 billion. EBITDA (adjusted) $1,514 million up 57% vs. year-ago. Mixed, but mostly strong year-over-year growth numbers from ONEOK. 2/27: American Electric Power (AEP) reported December quarter earnings (operating) of $1.23 per share, $0.03 below analyst forecasts, but up 11% vs. year-ago. Revenues down 6% to $4.6 billion. Mixed 4Q numbers from AEP. 2/27: American Electric Power replaced its CEO and Board Chair, no other details available. 2/27: Analyst Buy/Sell Rating Changes Comerica (CMA), cuts to neutral , target ↓$56, +14% upside For your information only, not Div. Det. recommendation change 2/23: VICI Properties (VICI) reported December quarter FFO (adjusted) of $0.55 per share, even with analyst forecasts, and up $0.04 vs. year-ago. Revenues up 21% to $931.9 million. 2/22: Chord Energy (CHRD) reported December quarter earnings (adjusted) of $5.27 per share, $0.34 above analyst forecasts, but down $0.01 vs. year-ago. Revenues down 5% to $964.7 million. Adjusted free cash flow down 19% vs. year-ago to $247.4 million. Mostly below year-ago numbers from Chord Energy. 2/22: Chord Energy declared $3.25 per share total dividend ($1.25 base + $2.00 variable) vs. year-ago $4.80 total). /22: Chord Energy (CHRD) agreed to acquire Enerplus (ERF) for around $11 billion in cash and stock. creating a Williston Basin-focused E&P compan 2/22: Dominion Energy (D) reported December quarter earnings (operating) of $0.29 per share, $0.06 below analyst forecasts, and vs. year-ago $0.76. Revenues down 7% to $3.534 billion. Disappointing December quarter numbers from Dominion Energy. 2/20: Analyst Buy/Sell Rating Changes Caterpillar (CAT), cuts to in-line , target ↑$338, +7% upside For your information only, not Div. Det. recommendation change 2/16: NextEra Energy (NEE) raised its quarterly dividend by 10% to $0.515 per share. 2/16: Arbor Realty (ABR) reported December quarter distributable EPS $0.51, $0.02 above analysts but $0.09 below year-ago. Net interest income down 8% vs. year-ago to $103.5 million. Below year-ago numbers from Arbor Realty. 2/15: Getty Realty (GTY) reported December quarter FFO (adjusted) of $0.57 per share, $0.01 above analyst forecasts, and up 4% vs. year-ago. Revenues up 10% to $47.64 million. Rental Income up 9% to $41.14 million. Real estate portfolio (net) up 13% vs. year-ago to $1.613 billion. Okay year-over-year growth numbers from Getty. 2/15: Ventas (VTR) reported December quarter FFO (normalized) of $0.76 per share, even with analyst forecasts and up 4% vs. year-ago. Revenues up 11% to $1.164 billion. Okay, but not great growth numbers from Ventas. 2/15: Franklin BSP Realty Trust (FBRT) reported December quarter distributable EPS $0.39, up 5% vs. year-ago. Total income for the year ending 12/31/23 $263.9 million vs. year-ago $206.8 million. Mixed, but on balance, weak growth numbers. 2/15: Targa Resources (TRGP) reported December quarter net income down 6.% vs. year-ago to $299.6 million. Revenues down 7% to $4.24 billion. Disappointing numbers from Targa Resources. 2/15: Corebridge Financial (CRBG) reported December quarter operating earnings of $1.04 per share, $0.05 above analyst forecasts, and up 18% vs. year-ago. Net investment income up 18% to $3,012 million. Book value (adjusted) $36.82 per share vs. year-ago $36.34 Adjusted ROE 11.2% vs. year-ago 10.4%. Mostly strong year-over-year growth numbers from Corebridge. 2/15: Analyst Buy/Sell Rating Changes Ingredion (INGR), ups to buy , target ↑$135, +19% upside For your information only, not Div. Det. recommendation change 2/14: Chemours (CC) said it would delay its December quarter earnings report from today to 2/28 because it "needs additional time to complete its year-end reporting process." 2/12: AJ Gallagher (AJG) acquired London-based workplace communications consultant Wright Agency Limited, dba Simply-Communicate Ltd. 2/12: Analyst Buy/Sell Rating Changes PepsiCo (PEP), ups to buy , target ↑$195, +16% upside For your information only, not Div. Det. recommendation change 2/9: TELUS (TU) reported December quarter earnings (adjusted) of $0.18 per share, $0.01 above analyst forecasts, and up $0.01 vs. year-ago. Revenues up 2% to $3.82 billion. Disappointing numbers from TELUS. 2/9: Magna International (MGA) reported December quarter earnings (adjusted) of $1.33 per share, $0.15 below analyst forecasts, but up 41% vs. year-ago. Revenues up 9% to $10.454 billion. Missed analyst estimates, but still a strong report from Magna. 2/9: PepsiCo (PEP) reported December quarter earnings (core) of $1.78 per share, $0.06 above analyst forecasts, and up 7% vs. year-ago. Revenues down 0.5% to $27.9 billion. Mixed, but on balance okay numbers from PepsiCo. 2/9: Blue Owl Capital (OWL) reported December quarter earnings (adjusted) of $0.18 per share, $0.01 above analyst forecasts, and up 20% vs. year-ago. Revenues up 25% to $404 million. Assets under management up 20% vs. year-ago to $165.7 billion. Strong year-over-year growth numbers from Blue Owl. 2/9: Dividend hikes announced today; Magna International (MGA) +3%, PepsiCo (PEP) +7%. 2/8: The February 2024 issue of D.D. Highlights is ready for download. Click here. 2/8: Ares Management (ARES) reported December quarter earnings of $1.21 per share, $0.08 above analyst forecasts, and even with year-ago. Assets under management up 19% to $418.8 billion. Okay, but not great numbers from Ares. 2/8: Ares Management raised its quarterly dividend by 21% to $0.93 per share. 2/8: Analyst Buy/Sell Rating Changes ONEOK (OKE), ups to buy , target $76, +10% upside For your information only, not Div. Det. recommendation change 2/7: Investible Special Dividend alert, $2.50 per share, 2.0% yield, click here 2/7: Ingredion (INGR) reported December quarter earnings (adjusted) of $1.97 per share, $0.13 above analyst forecasts, and up 19% vs. year-ago. Revenues down 3% to $1.92 billion. Operating income (adjusted) up 21% to $203 million. Mixed, but mostly strong growth numbers from Ingredion. 2/7: Ares Capital (ARCC) reported December quarter earnings (core) of $0.63 per share, $0.03 above analyst forecasts, and even with year-ago. Net investment income $0.60 per share vs. year-ago $0.68. Total portfolio investments up 5% vs. year-ago to $22.874 billion. Net asset value $19.24 per share vs. year-ago $18.40. Mixed, but generally disappointing numbers from Ares Capital. 2/7: Emerson Electric (EMR) reported December quarter earnings (adjusted) of $1.22 per share, $0.18 above analyst forecasts, and up 56% vs. year-ago. Revenues up 22% to $4.12 billion. Free cash flow up 51% to $367 million. Impressive year-over-year growth numbers from Emerson. 2/7: Analyst Buy/Sell Rating Changes Caterpillar (CAT), ups to buy For your information only, not Div. Det. recommendation change 2/6: Analyst Buy/Sell Rating Changes McDonald's (MCD), cuts to neutral Chevron (CVX), cuts to hold, target $160, +5% upside For your information only, not Div. Det. recommendation change 2/6: Due to delays triggered by storm issues in Sunny California, the February issue of Dividend Detective Highlights will be mailed today, 2/6, instead of 2/5.2/5: Investible Special Dividend alert, $2.44 per share, 5.3% yield, click here2/5: DD Model Portfolios have been updated for February. Click here2/5: Caterpillar (CAT) reported December quarter earnings (adjusted) of $5.23 per share, $0.85 above analyst forecasts, and up 32% vs. year-ago. Revenues up 3% to $17.1 billion. Strong earnings growth numbers from Caterpillar. 2/5: McDonalds (MCD) reported December quarter earnings (adjusted) of $2.95 per share, $0.13 above analyst forecasts, and up 14% vs. year-ago. Revenues up 8% to $6.406 billion. Global comparable store sales up 3% vs. year-ago. U.S. store comparable sales up 3%. Good growth numbers from McDonalds. 2/5: A.J. Gallagher (AJG) acquired Florida-based John Galt Commercial Insurance Agency.2/2: PennyMac Mortgage Investment Trust (PMT) reported December quarter earnings of $0.44 per share, $0.12 above analyst forecasts, and vs. year-ago loss. Net investment income $84.8 million, up 72% vs. year-ago. Book value $16.13 per share vs. year-ago $15.79. Strong year-over-year growth numbers from PennyMac.2/2: Chevron (CVX) reported December quarter earnings (adjusted) of $3.45 per share, $0.35 above analyst forecasts, but down from year-ago $4.09. Revenues down 16% to $47.18 billion. Upstream earnings $1,586 million vs. year-ago $5,485 million. Downstream earnings $1,147 million vs. $1,771 million. Operating cash flow $12.4 billion vs. year-ago $12.5 billion. Total quarterly production up 34% to 1.6M boe/day. Mostly disappointing year-over-year numbers from Chevron. 2/2: Baker Hughes (BKR) increased its quarterly dividend by 5% to $0.21 per share. 2/2: Chevron (CVX) hiked its quarterly dividend by 8% to $1.63 per share. 2/1: MetLife (MET) reported December quarter earnings of $1.83 per share, $0.09 above analyst forecasts, and up 15% vs. year-ago. Revenues up 18% to $19.03 billion. Book value (adjusted) down 1% vs. year-ago to $53.75 per share. Adjusted ROE 14.6% vs. year-ago 12.1%. Strong growth numbers from MetLife. 2/1: Qualcomm (QCOM) reported December quarter earnings (adjusted) of $2.75 per share, $0.39 above analyst forecasts, and up 16% vs. year-ago. Revenues up 5% to $9.935 billion. Handsets revenue up 16% to $6.69 billion. Automotive revenues up 31% to $598 million. Internet of things (IoT) revenues down 32% to 1.14 billion. Mixed but mostly strong year-over-year growth numbers from Qualcomm. 2/1: Analyst Buy/Sell Rating Changes Qualcomm (QCOM), cuts to neutral, target $160, +12% upside For your information only, not Div. Det. recommendation change 1/31: January Preferred Stocks Wrap-up: Our portfolio averaged a 3.3% return in January compared to a -0.9% loss for Equal Weighted S&P Index. Looking at January's best picks, Brighthouse Financial up 13.3%, Brookfield Infrastructure, up 7.9%, and Ford Motor, up 6.2%, did the best. On the downside, Aspen Insurance, down 5.0%, Carlyle Financial, down 1.5%, and Apollo Global, down 1.4%, were our biggest losers. As of January 31, 8 of our 26 buy-rated preferreds were still paying 8%+ dividend yields. 1/31: AJ. Gallagher (AJG) acquired Connecticut-based Ericson Insurance Services, LLC, dba Ericson Insurance Advisors. 1/30: PotlatchDeltic (PCH) reported December quarter EPS of $0.00 per share, $0.03 above analyst forecasts, but down from year-ago +$0.05. Revenues up 1% to $254.5 million. Net Operating cash flow $41.8 million vs. $33.5 million. Strong (+25%) year-over-year operating cash flow growth. 1/30: AJ. Gallagher (AJG) acquired Washington, Iowa-based retail property/casualty insurance agency Horak Insurance. 1/30: Microsoft (MSFT) reported December quarter earnings (adjusted) of $2.93 per share, $0.19 above analyst forecasts, and up 26% vs. year-ago. Total revenues up 18% to $62.0 billion. Intelligent Cloud revenues up 20% to $25.9 billion. Productivity and Business Process (MS Office, LinkedIn, Dynamics) revenues up 13% to $19.2 billion. Personal computing revenues up 19% to $16.9 billion. Operating cash flow $18.85 billion vs. year-ago $11.17 billion. Strong year-over-year growth numbers from Microsoft. 1/29: Investible Special Dividend alert, $3.00 per share, 15.5% yield, click here 1/29: AJ Gallagher (AJG) acquired commercial lines wholesale insurance broker and managing general agency, Forest Insurance Facilities, which serves clients throughout Louisiana. 1/29: Analyst Buy/Sell Rating Changes Comerica (CMA), cuts to hold Baker Hughes (BKR), cuts to Peer Perform For your information only, not Div. Det. recommendation change 1/26: ClearBridge MLP and Midstream Fund (CEM), ClearBridge Energy Midstream Opportunity Fund( EMO), ClearBridge MLP and Midstream Total Return Fund (CTR) are planning to merge, subject to shareholder's approval. 1/25: Blue Owl Capital began trading today on the NYSE using its new ticker symbol "OBDE". 1/25: AJ Gallagher (AJG) reported December quarter earnings (adjusted) of $1.85 per share, $0.01 above analyst forecasts, and up 24% vs. year-ago. Revenues up 19% to $2.39 billion. Brokerage EPS (adjusted) up 22% to $2.01. Risk management EPS (adjusted) up 31% to $0.16. Strong year-over-year growth numbers from AJG. 1/25: IBM (IBM) reported December quarter earnings (adjusted) of $3.87 per share, $0.07 above analyst forecasts, and up 20% vs. year-ago. Revenues up 4% to $17.4 billion. Total revenues up 4% to $17.38 billion. Software revenues up 3% to $7.5 billion. Consulting revenues up 6% to $5.0 billion. Infrastructure revenues up 3% to $3.3 billion. Free cash flow $6.09 billion, up 7% vs. year-ago. Okay growth numbers from IBM. 1/25: AJ Gallagher (AJG) raised its quarterly dividend by 9% to $0.60 per share. 1/25: NextEra Energy (NEE) reported December quarter earnings (adjusted) of $0.52 per share, $0.01 above analyst forecasts, and up $0.01 vs. year-ago. Revenues up 12% to $6.877 billion. Florida Power & Light EPS (adjusted) up 8% to $0.41. NextEra Energy Resources, its unregulated unit, EPS (adjusted) down 14% vs. year-ago to $0.43. Mixed December quarter numbers from NextEra, but it expects 6%-8% EPS growth over the next two years. 1/25: Analyst Buy/Sell Rating Changes RTX (RTX), ups to neutral, target ↑$100, +11% upside For your information only, not Div. Det. recommendation change 1/24: Baker Hughes (BKR) reported December quarter earnings of $0.51 per share, $0.04 above analyst forecasts, and up 34% vs. year-ago. Revenues up 16% to $6.835 billion. Free cash flow $663 million vs. year-ago $657 million. Good year-over-year growth numbers from Baker Hughes, but it said it expects that spending on drilling and well completion in North America will decline in 2024, more than offsetting international growth. 1/23: RTX (RTX) reported December quarter earnings (adjusted) of $1.29 per share, $0.04 above analyst forecasts, and up 2% vs. year-ago. Total Revenues (adjusted) up 2% to $19.8 billion. Collins Aerospace revenues up 14% to $7,120 million, Pratt & Whitney revenues up 14% to $6,439 million, and Raytheon Sales up 3% to $6,8862 million. Free cash flow $3.9 billion vs. year-ago $3.8 billion. Expects FY 2024 EPS of $5.25 - $5.40 vs. $5.06. Disappointing year-over-year growth numbers from RTX. 1/23: Analyst Buy/Sell Rating Changes Qualcomm (QCOM), starts at neutral, target $150, -1% downside Chevron (CVX), cuts to market perform, target ↓$150, +5% upside Broadcom (AVGO), starts at overweight, target $1,300, +7% upside For your information only, not Div. Det. recommendation change 1/22: Analyst Buy/Sell Rating Changes Comerica (CMA), cuts to market perform American Electric Power (AEP), cuts to neutral, target $81, +5% upside For your information only, not Div. Det. recommendation change 1/19: Targa Resources (TGP) said that it plans to hike its next (March quarter) dividend by by 50% to $0.75 per share. 1/19: Comerica (CMA) reported December quarter earnings of $0.20 per share, $1.18 below analyst forecasts, and vs. year-ago $1.84. Net interest income down 21% vs. year-ago to $584 million. Net interest margin 2.91% vs. 3.74%. Non-interest income up 29% to $198 million. Ending loan balance down 2% vs. year-ago to $52.11 billion. Ending deposit balance down 7% to $66.05 billion. Mixed, but mostly below year-ago December quarter results. 1/19: Analyst Buy/Sell Rating Changes IBM (IBM), ups to outperform, target ↑$200, +18% upside Broadcom (AVGO), ups to buy For your information only, not Div. Det. recommendation change 1/18: AJ Gallagher (AJG) acquired retail insurance broker The Rowley Agency based in Concord, New Hampshire. 1/18: Analyst Buy/Sell Rating Changes Microsoft (MSFT), ups to outperform, target $471, +21% upside For your information only, not Div. Det. recommendation change 1/17: ONEOK (OKE) raised its quarterly dividend by 4% to $0.99 per share. 1/17: Citizens Financial Group (CFG) reported December quarter earnings (underlying) of $0.85 per share, $0.10 above analyst forecasts, but down 36% vs. year-ago. Revenues down 26% to $1,988 million. Net interest income down 12% to $1.488 billion. Non-interest income down 1% to $500 million. Net interest margin 2.91% vs. 3.30%. Total loans down 7% to $146.0 billion. Deposits down 2% to $177.3 billion. Tangible book value up 11% to $30.91 per share. Better than expected but still mostly below year-ago numbers from Citizens Financial. 1/17: Penske Automotive (PAG) hiked its quarterly dividend by 10% to $0.87 per share, which was 43% above its year-ago payout. 1/16: Blue Owl Capital (OWL) intends to list its common stock on the New York Stock Exchange. It will commence trading on the NYSE on January 25, 2024, under the ticker symbol "OBDE". 1/16: AJ Gallagher's (AJG) Reinsurance unit, Gallagher Re, acquired Toronto, Ontario-based MGB Re. 1/16: Analyst Buy/Sell Rating Changes Ventas (VTR), ups to buy, target ↑$53, +8% upside Chevron (CVX), cuts to sector perform For your information only, not Div. Det. recommendation change 1/12: Analyst Buy/Sell Rating Changes Qualcomm (QCOM), ups to buy, target $160, +14% upside For your information only, not Div. Det. recommendation change 1/11: AJ Gallagher (AJG) acquired UK-based MCMM Services, which provides administrative and claims management services to members of Education Mutual, a mutual insurer that offers staff absence insurance to UK state schools and academies. 1/11: Analyst Buy/Sell Rating Changes American Electric Power (AEP), cuts to neutral, target $83, +2% upside For your information only, not Div. Det. recommendation change 1/10: Analyst Buy/Sell Rating Changes ONEOK (OKE), ups to peer perform. PennyMac Mortgage (PMT), starts at hold, target $15, 0% upside Franklin BSP Realty Trust (FBRT), ups to outperform, target $15, +9% upside AJ Gallagher (AJG), starts at market perform, target $249, +10% upside For your information only, not Div. Det. recommendation change 1/9: Analyst Buy/Sell Rating Changes MetLife (MET), ups to buy. AJ Gallagher (AJG), cuts to hold, target ↓$233, +4% upside Ares Capital (ARCC), cuts to neutral, target $21, +3% upside For your information only, not Div. Det. recommendation change 1/8: AJ Gallagher (AJG) acquired insurance broker Koberich Financial Lines, based in Germany. 1/8: Analyst Buy/Sell Rating Changes Caterpillar (CAT), starts at equal weight, target $270, -6% downside Chevron (CVX), ups to buy, target $184, +25% upside Ares Capital (ARCC), cuts to neutral, target $21 +3% upside For your information only, not Div. Det. recommendation change 1/6: DD's Stock and Fund portfolio returns have been updated for December and Year 2023. Click here 1/5: Analyst Buy/Sell Rating Changes IBM (IBM), starts at hold McDonald's (MCD), cuts to perform For your information only, not Div. Det. recommendation change 1/4: DD Model Portfolios have been updated for January. Click here 1/4: Analyst Buy/Sell Rating Changes Comerica (CFG), ups to buy, target $70.50, +26% upside Blue Owl Capital (OWL), starts at outperform, target $17, +13% upside Emerson Electric (EMR), ups to buy, target ↑$118, +23% upside TELUS (TU), cuts to neutral For your information only, not Div. Det. recommendation change 1/3: Analyst Buy/Sell Rating Changes Magna Intl. (MGA), cuts to neutral, target ↓$58, 0% upside For your information only, not Div. Det. recommendation change 1/2: Analyst Buy/Sell Rating Changes Citizens Financial (CFG), cuts to Equal Weight, target ↑$40, +21% upside For your information only, not Div. Det. recommendation change 12/27: American Electric Power (AEP) sold its 50% interest in New Mexico Renewable Development (NMRD) to Exus North America. 12/26: Penske Automotive (PAG) acquired Don Allen Auto Service, a Massachusetts-based auto dealership for $12.4 million. 12/22: Broadcom (AVGO) said a district court in Germany fined Netflix (NFLX) €7.05 million for its infringement of a AVGO patent. 12/20: Analyst Buy/Sell Rating Changes McDonald's (MCD), starts at buy, target $317, +9% upside For your information only, not Div. Det. recommendation change 12/19: Harry's Hot Portfolios • Two New Portfolios.• Click Here 12/19: Analyst Buy/Sell Rating Changes PepsiCo (PEP), cuts to neutral, target ↓$176, +5% upside For your information only, not Div. Det. recommendation change 12/18: Law enforcement agencies in northern China have shut down large-scale manufacturing of counterfeit Viton FreeFlow fluoroelastomer, a product falsely bearing Chemours'(CC) trademarks, at a local chemical plant. 12/15: Analyst Buy/Sell Rating Changes AJ Gallagher (AJG), cuts to underperform, target ↓$230, +3% upside For your information only, not Div. Det. recommendation change 12/14: Investible Special Dividend alert, $12.27 per share, 2.4% yield, click here 12/13: Analyst Buy/Sell Rating Changes Microsoft (MSFT), starts at buy For your information only, not Div. Det. recommendation change 12/12: Analyst Buy/Sell Rating Changes Comerica (CMA), cuts to neutral, target $57, +16% upside A.J. Gallagher (AJG), cuts to market perform For your information only, not Div. Det. recommendation change 12/11: Penske Automotive (PAG) agreed to acquire Rybrook Group, which owns 15 premium auto dealerships in the UK. 12/11: Analyst Buy/Sell Rating Changes Devon Energy (DVN), ups to buy, target ↑$52, +18% upside Broadcom (AVGO), starts at buy, target $1,100, +10% upside For your information only, not Div. Det. recommendation change (12/8) Broadcom (AVGO) reported October quarter earnings (adjusted) of $11.06 per share, $0.11 above analyst forecasts, and up 5% vs. year-ago. Total revenues up 4% to $9.295 billion. Semiconductor revenues up 3% to $7,326 million. Infrastructure software revenues up 7% to $1,969 million. Free cash flow $4,723 million vs. $4,461 million. Forecast 40% revenue growth for fiscal 2024. Modest year-over-year growth numbers, but strong guidance for next year. 12/8: Broadcom increased its quarterly dividend by 14% to $5.25 per share. 12/8: A. J. Gallagher (AJG) acquired Australia-based My Plan Manager Group. 12/8: Columbia Seligman Premium Technology Growth (STK) declared $0.2669 per share special dividend. 12/8: Analyst Buy/Sell Rating Changes VICI Properties (VICI), starts at buy, target $36, +18% upside NextEra Energy (NEE), starts at buy, target $69, +15% upside Qualcomm (QCOM), cuts to equal weight, target ↑$132, 0% upside Broadcom (AVGO), ups to buy For your information only, not Div. Det. recommendation change 12/7: Investible Special Dividend alert, $8.00 per share, 108% yield, click here 12/7: Investible Special Dividend alert, $2.00 per share, 9.8% yield, click here 12/7: McDonald's (MCD) has begun testing a new small store format called CosMc's this week, earlier than it previously expected, with plans to open 10 such restaurants by the end of 2024. 12/6: Investible Special Dividend alert, $2.85 per share, 6.8% yield, click here 12/6: Investible Special Dividend alert, $3.20 per share, 3.4% yield, click here 12/6: Arthur J. Gallagher (AJG) acquired Palos Heights, Illinois-based Hunt Insurance Agency. 12/6: Analyst Buy/Sell Rating Changes PennyMac Mortgage (PMT), starts at neutral, target $13.50, -8% downside For your information only, not Div. Det. recommendation change 12/5: The December 2023 issue of D.D. Highlights is ready for download. Click here. 12/5: Analyst Buy/Sell Rating Changes Microsoft (MSFT), starts at buy, target $466, +26% upside For your information only, not Div. Det. recommendation change 12/4: DD Model Portfolios have been updated for December. Click here 12/4: Analyst Buy/Sell Rating Changes ONEOK (OKE), ups to buy, target ↑$83, +18% upside Citizens Financial (CFG), cuts to equal weight, target $31, +9% upside For your information only, not Div. Det. recommendation change 12/1: Analyst Buy/Sell Rating Changes Chemours (CC), ups to outperform, target ↑$40, +38% upside For your information only, not Div. Det. recommendation change 11/29: Chemours (CC), along with DuPont de Nemours (DD), and Corteva (CTVA), agreed to a $110 million settlement with the state of Ohio over claims related to “forever chemicals” pollution from a plastics factory near the Ohio River. 11/28: Chemours Company (CC) and Advanced Performance Materials, announced the creation of an international F-gas Lifecycle Program across the Americas, Asia, and Europe. The program aims to advance safe, global recovery, reclaim, and reuse of fluorinated gases across its low global warming potential (GWP) Opteon products, Freon refrigerants, and FM-200 portfolios. 11/23: Happy Thanksgiving 11/22: Broadcom (AVGO) completed its acquisition of VMware (VMW). 11/21: A. J. Gallagher (AJG) acquired Queensbury, New York-based Hughes Insurance Agency. 11/20: Emerson (EMR) announced a strategic investment in Frugal Technologies, a Danish-based company that offers fuel optimization technologies that reduce energy use and emissions in shipping fleets. 11/20: McDonald's (MCD) agreed to acquire Carlyle's minority stake in the strategic partnership that operates and manages McDonald's business in mainland China, Hong Kong and Macau. 11/20: Analyst Buy/Sell Rating Changes Caterpillar (CAT), starts at hold, target $250 For your information only, not Div. Det. recommendation change 11/16: Investible Special Dividend alert, $20.00 per share, 6.8% yield, click here 11/16: Investible Special Dividend alert, $1.10 per share, 8.6% yield, click here 11/16: AJ Gallagher (AJG) acquired East Lansing, Michigan-based Covery's Insurance Services. 11/15: Analyst Buy/Sell Rating Changes RTX (RTX), cuts to neutral For your information only, not Div. Det. recommendation change 11/14: A.J. Gallagher (AJG) acquired Australian commercial insurance broker Edgar Insurance Brokers. 11/13: Analyst Buy/Sell Rating Changes PepsiCo (PEP), starts at buy, target $203, +21% upside For your information only, not Div. Det. recommendation change 11/10 Investible Special Dividend alert, $2.27 per share, 1.7% yield, click here 11/10 Investible Special Dividend alert, $35.00 per share, 3.6% yield, click here 11/9: Analyst Buy/Sell Rating Changes Devon Energy (DVN), ups to outperform NextEra Energy (NEE), cuts to sell, target $44, -22% downside For your information only, not Div. Det. recommendation change 11/8: Greystone Housing Impact Investors (GHI) reported September quarter earnings of $0.39 per unit, $0.15 above analyst forecasts, but vs. year-ago $0.77. Revenues up 17% to $26.5 million. Cash available for distribution $0.25 per unit vs. year-ago $0.52. Mixed, but mostly below year-ago numbers. 11/8: Arthur J. Gallagher (AJG) acquired Farmington, Connecticut-based employee benefits agency WDK Benefits, LLC. 11/8: Devon Energy (DVN) raised its quarterly dividend by 57% from previous to $0.77 per share, which was still 43% below year-ago.