If you like dividends,

you’ll LOVE Dividend Detective

ABOUT DIVIDEND DETECTIVE PREMIUM

Too Many Stocks, Too Little Time?

Let us do it all for you: screening, research, analysis, and tracking

click here for Dividend Detective Home

Current Subscribers: Click here to log-on, or here for Customer Service

closed to new subscribers

“Sure, I want to make money in the market, but not by taking unnecessary risks.

Dividend Detective recommends stocks, funds, and other securities to serve the needs

of investors like me. I'll keep you up to date on all recommended stocks and funds,

and most important, I'll tell you when to sell.

Our most popular features include Dividend Detective Highlights, an e-mailed monthly

executive summary of DD's most read sections, and Model Portfolios, our best ideas for busy

subscribers who don't have time to study everything that we offer in depth. Here's a rundown on

those, plus the many other features that we offer."

Harry Domash

About Harry Domash click here

DIVIDEND DETECTIVE PREMIUM FEATURES

DIVIDEND DETECTIVE HIGHLIGHTS

Printable report includes Dividend Detective's

most popular features. Updated monthly. Click

here to see a sample issue.

MODEL PORTFOLIOS

Too many choices? Here's the short list. Four

model portfolios focused on different investing

priorities: Monthly Retirement, Conservative,

Growth & Income, and High Yield/Speculative.

Click here to see monthly returns since 2008.

MANAGED PORTFOLIOS.

Two categories, Specialty & Industry: each

portfolio contains individually researched

securities with our buy/sell recommendations and

risk ratings. Click here to see recent portfolio

returns.

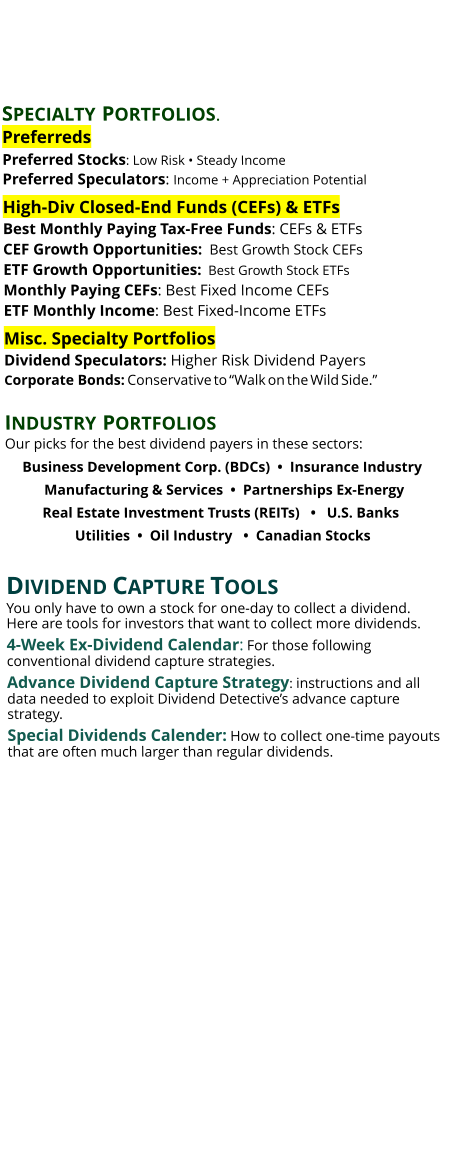

SPECIALTY PORTFOLIOS.

Preferreds

Preferred Stocks: Low Risk • Steady Income

Preferred Speculators: Income + Appreciation Potential

High-Div Closed-End Funds (CEFs) & ETFs

Best Monthly Paying Tax-Free Funds: CEFs & ETFs

CEF Growth Opportunities: Best Growth Stock CEFs

ETF Growth Opportunities: Best Growth Stock ETFs

Monthly Paying CEFs: Best Fixed Income CEFs

ETF Monthly Income: Best Fixed-Income ETFs

Misc. Specialty Portfolios

Dividend Speculators: Higher Risk Dividend Payers

INDUSTRY PORTFOLIOS

Our picks for the best dividend payers in these sectors:

Business Development Corp. (BDCs)

Energy Partnerships (MLPs)

Insurance Industry

Manufacturing & Services

Partnerships Ex-Energy

Real Estate Investment Trusts (REITs)

U.S. Banks

Utilities

Oil Industry

Canadian Stocks

DIVIDEND CAPTURE TOOLS

You only have to own a stock for one-day to collect a

dividend. Here are tools for investors that want to

collect more dividends.

4-Week Ex-Dividend Calendar: For those following

conventional dividend capture strategies.

Advance Dividend Capture Strategy: instructions

and all data needed to exploit Dividend Detective’s

advance capture strategy.

Special Dividends Calender: How to collect one-

time payouts that are often much larger than regular

dividends.

RESEARCH TOOLS

Tools and data you need to find and evaluate

opportunities on your own.

Breaking News; news affecting dividend payers,

continuously updated.

What’s Hot Now - What’s Not?: 500+ dividend payers

in 65+ categories tracked daily including 12-month, 3-month

and one month returns, trend scores, ex-div dates and

optionable flags.

Monthly-Payers Scoreboard: Compressive including

performance data and ex-dates for 350+ monthly

dividend payers . Updated daily.

Dividend Workshop: Valuable tools for Do It Yourself

high-dividend investors.

DIVIDEND IDEAS

Dividend Monsters: 50 highest yielding dividend

payers.

Monthly Monsters: 25 highest yielding monthly

payers.

Preferred Monsters: 25 highest yielding “investment

quality” preferred stocks.

Monthly-Paying Preferreds: All investable preferred

stocks paying monthly dividends.

High-Dividend ETFs: More than 350 ETFs paying 2%+

dividend yields including more than 100 paying 4% or

higher.

All foreign stocks trading on U.S. exchanges as ADRs

paying 2.5% or higher dividend yields.

“Sure, I want to make money in the market,

but not by taking unnecessary risks.

Dividend Detective recommends stocks,

funds, and other securities to serve the

needs of investors like me. I'll keep you up to

date on all recommended stocks and funds,

and most important, I'll tell you when to sell.

ABOUT DIVIDEND DETECTIVE PREMIUM

Too Many Stocks, Too Little Time?

Let us do it all for you: screening, research, and analysis.

Click here for Dividend Detective Home

Current Subscribers: Click here to log-on, or here for Customer Service

closed to new subscribers

DIVIDEND DETECTIVE PREMIUM FEATURES

RESEARCH TOOLS

Tools and data you need to find and evaluate opportunities on

your own.

Breaking News; news affecting dividend payers, continuously

updated.

What’s Hot Now - What’s Not?: 500+ dividend payers in 65+

categories tracked daily including 12-month, 3-month and one month

returns, trend scores, ex-div dates and optionable flags.

Dividend Workshop: Valuable tools for Do It Yourself high-

dividend investors.

DIVIDEND IDEAS

Dividend Monsters: 50 highest yielding dividend payers.

Monthly Monsters: 25 highest yielding monthly payers.

Preferred Monsters: 25 highest yielding “investment quality”

preferred stocks.

Monthly-Paying Preferreds: All investable preferred stocks

paying monthly dividends.

High-Dividend ETFs: More than 350 ETFs paying 2%+ dividend

yields including more than 100 paying 4% or higher.

All foreign stocks trading on U.S. exchanges as ADRs paying

2.5% or higher dividend yields.

$5 first month • then $15/month •

No Minimum Subscription • Cancel Anytime

Prices include all premium features

DIVIDEND DETECTIVE HIGHLIGHTS

Printable report includes D.D.s most popular features.

Updated monthly. Click here to see a sample issue.

MODEL PORTFOLIOS

Too many choices? Here's the short list. Four model

portfolios focused on different investing priorities: Monthly

Retirement, Conservative, Growth & Income, and High

Yield/Speculative. Click here to see monthly returns since

2008.

MANAGED PORTFOLIOS

Two categories, Specialty & Industry: each portfolio contains

individually researched securities with our buy/sell

recommendations and risk ratings. Click here to see recent

portfolio returns.

Div. Det.